Auto Insurance in and around Columbus

Discover your car insurance options from State Farm

Time to get a move on, safely.

Would you like to create a personalized auto quote?

State Farm Has Coverages For Your Needs

Falling objects, fire and vandalism, oh my! Even the most attentive drivers know that sometimes the unexpected happens. No one knows what to expect down the highway.

Discover your car insurance options from State Farm

Time to get a move on, safely.

Protect Your Ride

With Amy Shelton's assistance, you'll get reliable coverage for your vehicles, from scooters to motorcycles. And Agent Amy Shelton can share more information about State Farm's savings options—such as our Safe Driver Program and Steer Clear®—and a wide range of policy inclusions—such as rideshare insurance and Emergency Roadside Service (ERS) coverage.

When unfortunate events put you off road, coverage from State Farm can help. Contact agent Amy Shelton to discover the advantages of State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Amy at (662) 327-3685 or visit our FAQ page.

Simple Insights®

This RV travel checklist helps you pack for your trip

This RV travel checklist helps you pack for your trip

If a road trip is on your agenda, this RV travel checklist can help you prepare for the open road by focusing on RV maintenance and other RV essentials.

How to buy a used car from a dealer or private seller

How to buy a used car from a dealer or private seller

A used car is a great way to save some cash, but consider these tips before you buy.

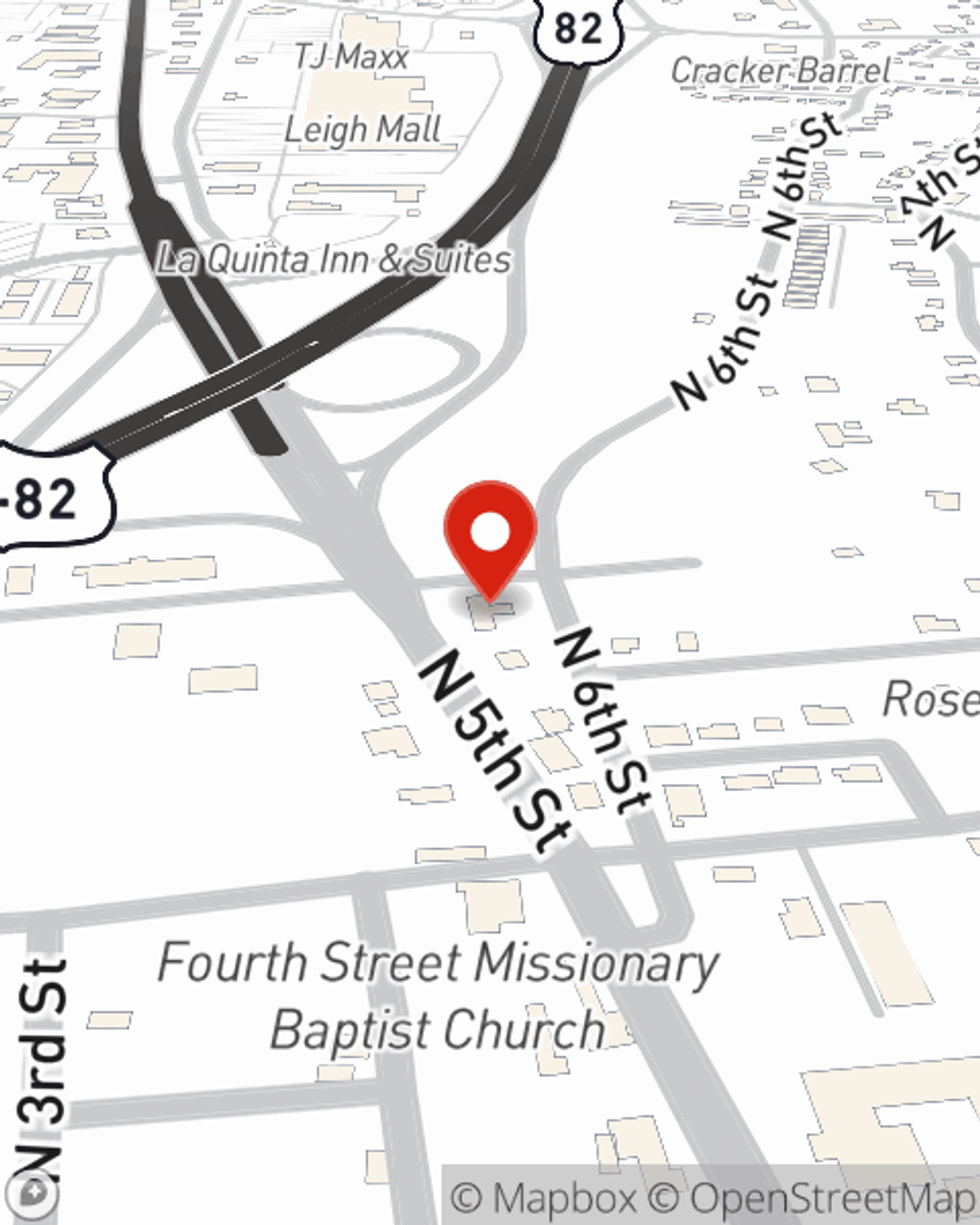

Amy Shelton

State Farm® Insurance AgentSimple Insights®

This RV travel checklist helps you pack for your trip

This RV travel checklist helps you pack for your trip

If a road trip is on your agenda, this RV travel checklist can help you prepare for the open road by focusing on RV maintenance and other RV essentials.

How to buy a used car from a dealer or private seller

How to buy a used car from a dealer or private seller

A used car is a great way to save some cash, but consider these tips before you buy.